Petty cash isn’t what it used to be. In the days when we paid for all small business transactions in cash, it was necessary to be intentional about keeping track of those transactions. In the 21st century, we have better ways to pay for small business purchases and keep track of them. But the concept of “petty cash” is still important.

What is Petty Cash?

Petty cash describes small transactions of a business. The term “petty” is used because it is small (petite) amounts of cash or cash-like transactions. “Petty” isn’t so small anymore, so think of it as small amounts that you might not think about tracking. In this article, we’ll use the term “petty cash” to include a variety of small business transactions.

For example:

- Buying coffee for the office coffeemaker

- Paying tolls or parking meters

- Treating employees to pizza to celebrate an accomplishment

- Buying a small gift on the way to a business meeting.

Why is Petty Cash Important?

Petty cash transactions add up. Not documenting and tracking those small purchases can mean lots of potential business expenses left unclaimed, like throwing them away.

How should petty cash transactions be recorded?

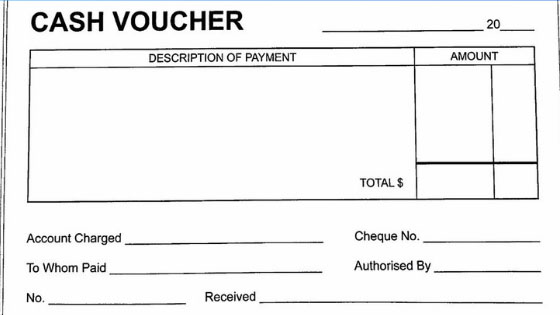

You can record on slips or a listing, whichever is easier. The important thing to remember is that EVERY transaction must be recorded and must include:

- Date of the transaction

- Amount of the transaction

- General description of the transaction (“donuts for an office meeting,” for example)

You don’t have to record the account number at the time of the transaction.

When you replenish petty cash, group transactions by account number and enter them in your bookkeeping program.

Can I track petty cash transactions online?

Smart business owners these days are paying for business transactions with business credit cards or debit cards and apps. You can track parking with an app, and you can use an automatic toll-paying system to eliminate time spent in the “cash-only” lane at toll roads. Of course, paying with your business debit or credit card makes tracking small expenses easy. Just be sure to note the business purpose on the receipt.

What if my business still has a cash box?

Many businesses have a petty cash fund in the office, especially retail businesses that have customers who pay in cash. The cash box is used for making change, and in some cases for small business transactions. Usually, the box starts with a balance in cash, in suitable denominations. Then, when the cash box gets low, it’s replenished.

If cash box funds are used for small purchases, keep a log in the box so these purchases can be recorded.

How do I make sure that all petty cash transactions get recorded?

It is your responsibility as a business owner to set up policies for use of petty cash, to monitor petty cash transactions, and to make sure that employees are using petty cash responsibly. Some possibilities:

- Give trusted employees a business debit card and require them to turn in details on business purpose for all their debit purchases.

- Require employees who use their own cars for business to have a tolling tracker. You can provide it and get the details. You will need the employee to verify business purpose.

- If employees have smartphones for business use, require them to include apps to capture receipts by photo or to send them to your bookkeeping department.

The Bottom Line on Petty Cash:

Setting up and keeping track of petty cash should be part of the overall record keeping system for your company. Remember, if you don’t record it, you can’t deduct it as a business expense. Make sure you are taking advantage of all those petty cash transactions, so you can claim more legitimate business expenses and lower your business taxes.